Chainlink has outperformed the rest of the sector with a strong rally over the past week. This is the reason for this, according to on-chain data.

Chainlink price has risen sharply recently

The last few weeks have been an excellent time for LINK investors, as the asset’s value has almost tripled compared to the beginning of November. The coin experienced a small pullback earlier this week, but the strong bullish momentum has already picked up again in the last few days.

Below is a chart showing LINK’s performance over the past few months:

The price of the coin seems to have rapidly been moving up recently | Source: LINKUSDT on TradingView

It can be seen from the chart that Chainlink managed to break through the $28 mark after a jump of over 47% from the low point earlier in the week. The asset is now making weekly gains of more than 22%, making it the best performer among the top cryptocurrencies Market capitalization.

Speaking of market capitalization: In terms of this metric, LINK is now the 12th largest in the industry, just above Shiba Inu (SHIB).

Looks like the market cap of the coin is $17.7 billion at the moment | Source: CoinMarketCap

As can be seen from the table above, Avalanche (AVAX) is the next asset to beat for Chainlink. Its market cap is still $3.5 billion more than LINK. So it would take a while for a reversal to occur unless the upward momentum fades.

As to what is driving the cryptocurrency’s rise, on-chain data may provide some clues.

LINK Sharks and whales were busy congregating

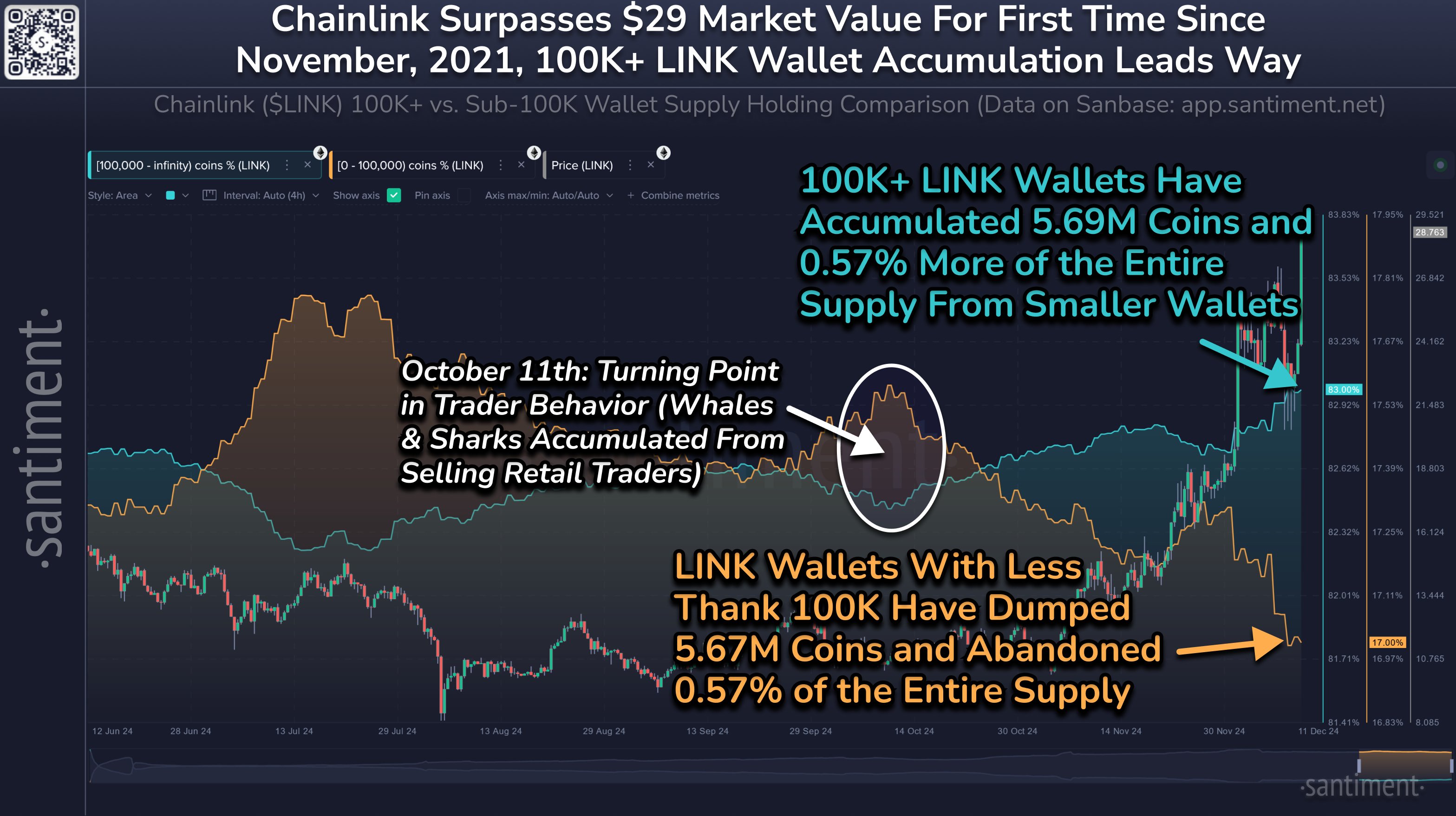

In a new one post On The relevance indicator here is “Supply distribution“, which tracks the total amount of Chainlink currently owned by members of a given wallet group.

In the context of the current topic, the two address ranges are of interest: 0 to 100,000 coins and 100,000+ coins. At the current exchange rate, the 100,000 barrier between the two groups is equivalent to about $2.8 million.

Addresses whose shares exceed this value are considered the most important investors in the market, the so-called Sharks and whales. The supply distribution for the group therefore follows the behavior of the large investors.

Now here is the chart shared by the analytics firm that shows how this indicator compares between the sharks and whales and the regular investors:

The metric appears to have gone opposite ways for the two cohorts | Source: Santiment on X

As shown in the chart above, small Chainlink investors have been selling over the past few months, perhaps because they did not believe LINK would turn around.

However, the sharks and whales sensed the opportunity and purchased a total of 5.69 million coins from this group. As Santiment explains,

Throughout the history of cryptocurrencies, large wallets scooping up coins from impatient or panicked retail traders has typically been a recipe for market cap increases.

Featured image from Dall-E, Santiment.net, chart from TradingView.com

Leave a Reply