According to a recent report According to Bitfinex, Bitcoin (BTC) breaking the psychologically significant $100,000 mark will largely depend on the actions of two key cohorts of holders – long-term holders (LTH) taking profits and short-term holders (STH) stimulating demand.

Demand from short-term holders is crucial to driving Bitcoin to $100,000

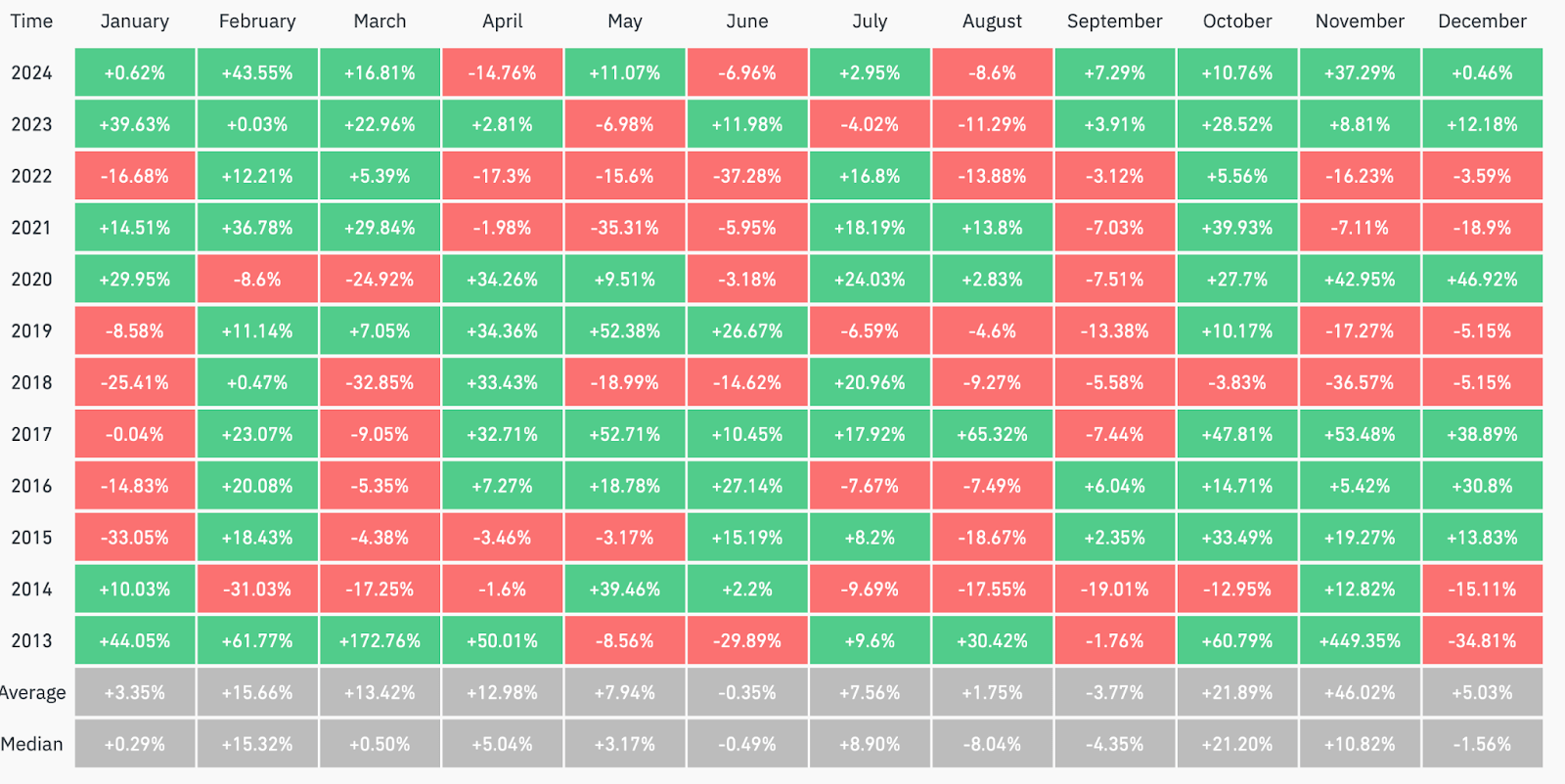

Bitcoin price rose an impressive 37.3% in November, closing the month at a record $96,506. However, for the flagship cryptocurrency to cross $100,000, the demand for STHs must match the supply of LTHs.

Historically, December has been one of the most volatile months for Bitcoin. However, the month typically delivers strong performance during halving years, with an average return of 38.86%. Since the last halving took place in April 2024, analysts believe that December could be favorable for BTC holders.

The latest edition of the “Bitfinex Alpha” report highlights several factors that are likely to drive Bitcoin forward over and beyond $100,000. The report notes that while short-term volatility may continue, the current bullish momentum in the cryptocurrency market suggests that further gains are likely.

The report also notes that short-term price declines – like the one seen last week when BTC briefly fell to $90,911 – are often due to ETF outflows and LTH profit-taking. Specifically, the report states:

Last week, ETFs saw net outflows of $135.1 million, with the bulk of that occurring in the first two days of trading. LTHs have distributed a significant 508,990 BTC since September, increasing supply to the market.

While the 508,990 BTC distributed by LTHs since September is notable, it remains lower than the 934,000 BTC distributed before the March 2024 highs. Nevertheless, continued demand from ETFs and retail customers will prevent further price declines.

As can be seen in the chart above, STH supply is close to its cycle high of 3,282,000 BTC. Based on previous data, the final phase of a bull run begins when STH supply rises above pre-halving cycle highs. The report reads:

This change shows However, increasing retail participation also highlights that the market relies on incoming demand to absorb LTH profit-taking.

For the uninitiated, STH supply typically means the total amount of BTC currently held by wallets or entities that acquired it within a relatively short period of time, typically less than 155 days. On the contrary, the LTH supply refers to the currently held BTC that were purchased more than 155 days ago.

Analysts are confident that $100,000 BTC is within reach

While BTC price continues to hover in the mid-$90,000 range, several prominent analysts believe that $100,000 represents just a small hurdle in BTC price’s uptrend. For example Cryptoquant predicted that BTC’s peak value for this cycle could be $146,000.

So does the investment management firm VanEck foresees BTC is hitting a high of $180,000 in the current cycle. At press time, BTC is trading at $95,238, down 1.2% in the last 24 hours.

Featured image from Unsplash.com, charts from Bitfinex, Glassnode and TradingView.com

Leave a Reply