Bitcoin surpassed $100,000 on Wednesday and hit a new all-time high of $104,088 on December 5. Crypto traders’ enthusiasm has been rewarded with significant capital inflows into spot Bitcoin ETFs and an increase in BTC options trading volume.

Following Bitcoin’s Recovery to $100,000 (BTC), traders are looking for the next altcoin to shift their focus to, expecting higher returns as the cycle progresses. Capital rotation is likely during altcoin season, and altcoins like Ethereum (ETH), rendering (RNDR), Sui (SUI), Pepe (PEPE), hyperfluidity (HYPE) and Ondo (ONDO).

The peak of the Bitcoin cycle and the direction BTC moves after $104,000

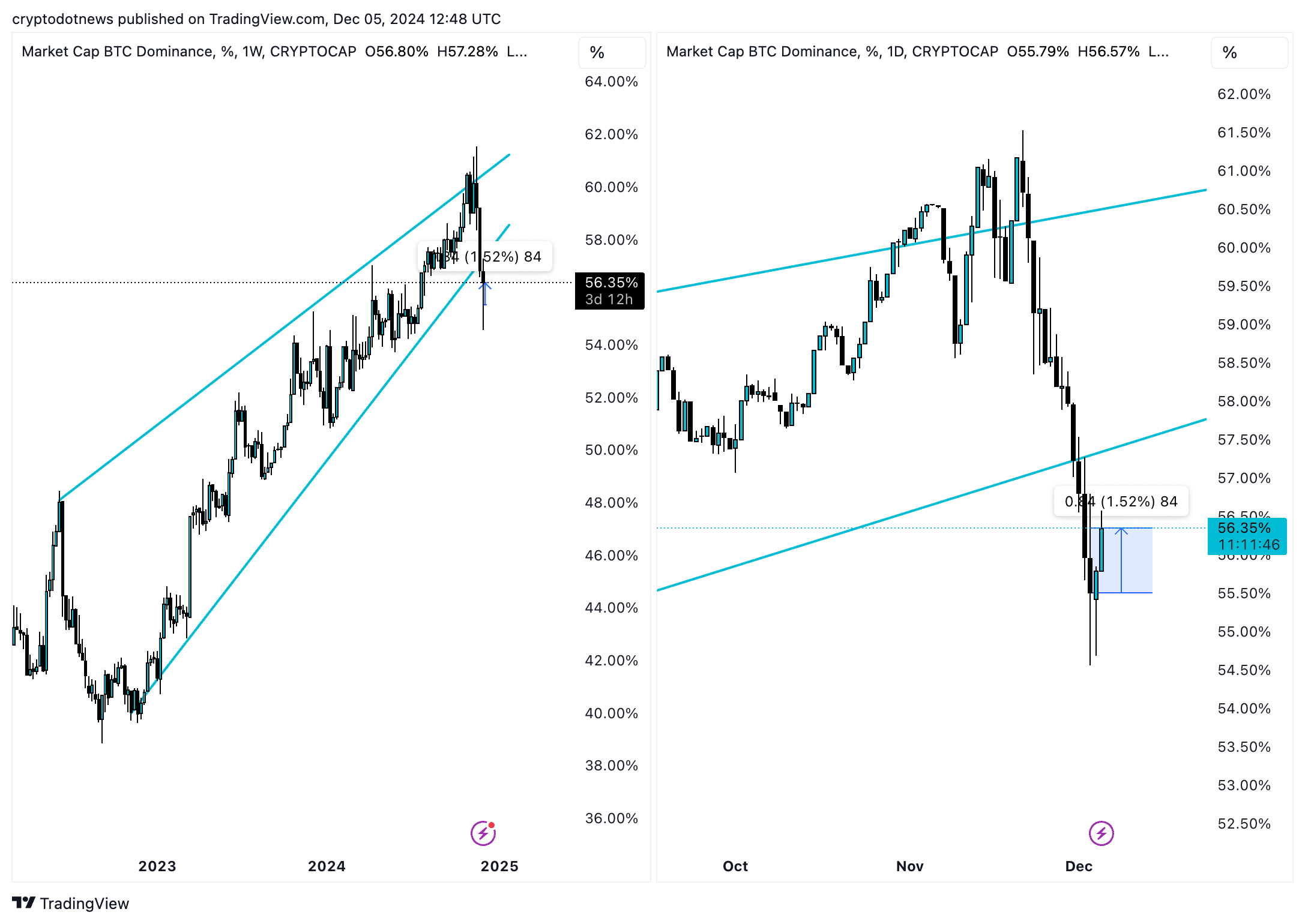

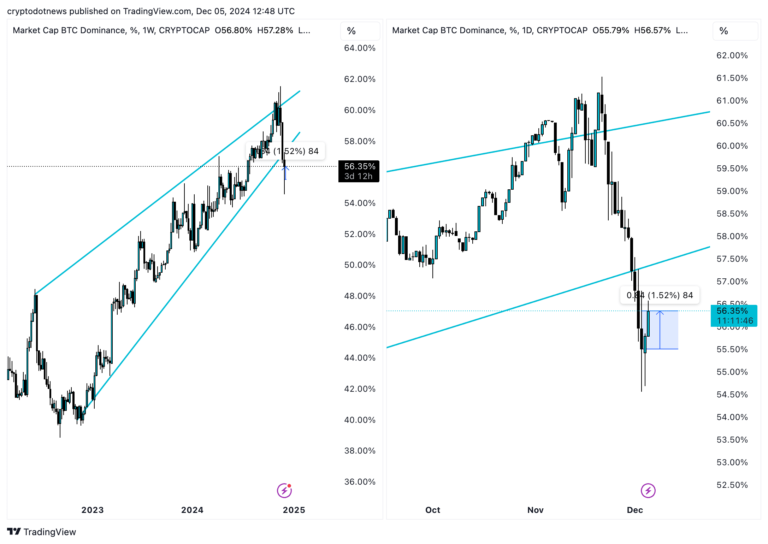

The top Bitcoin Pi cycle indicator predicts a break above $125,494 before BTC crosses this market cycle. Bitcoin is 22% below target and dominance has increased by almost 2% in two days.

Bitcoin’s increasing dominance signals that there is more upside potential and BTC could extend its gains. Interestingly, altcoin season is in full swing, with 75% of the top 100 altcoins outperforming BTC within 90 days.

BTC is heading towards a multiple of the 350-day moving average of the Pi cycle’s top indicator, and increasing dominance supports a bullish thesis for the largest cryptocurrency.

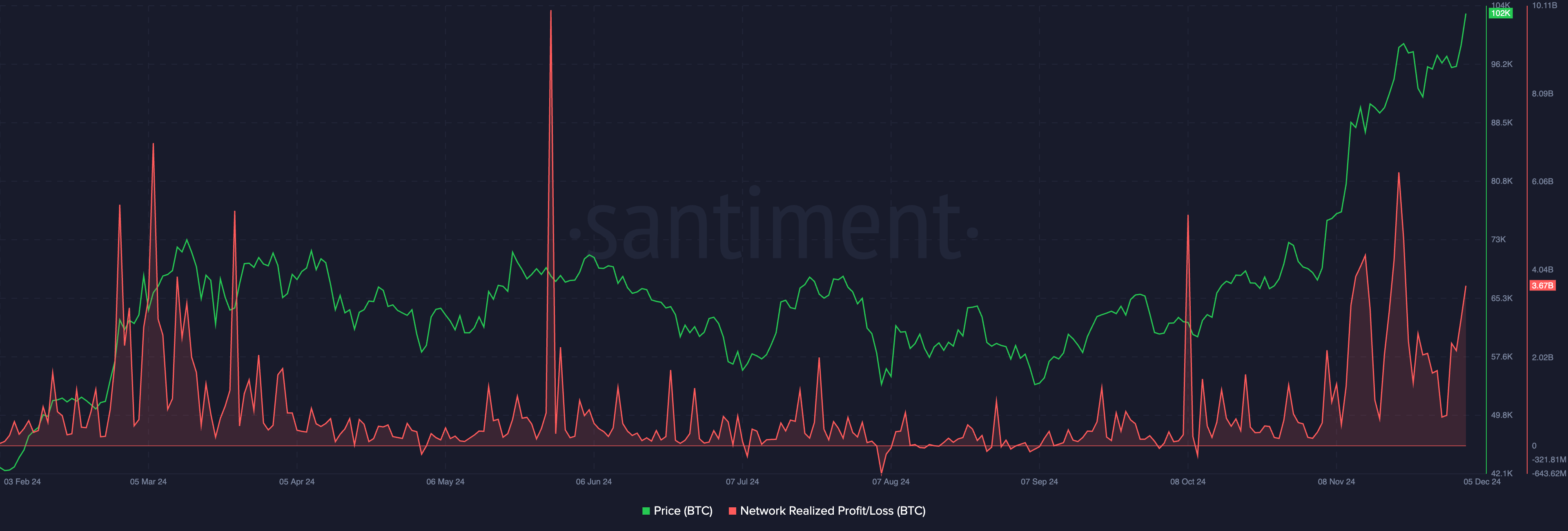

The network-realized profit/loss metric on Santiment shows that traders are continually taking profits from their Bitcoin holdings. Several large spikes were observed between October 8th and December 5th, but these are relatively small compared to the peak in May 2024, when BTC price hovered around the $70,000 mark.

Larger and more concentrated spikes in NPL metrics could indicate the likelihood of a correction in BTC due to increasing selling pressure on crypto exchanges.

Altcoins to keep an eye on this week

Blockchain.centre’s Altcoin Seasonal Index suggests that altcoins could continue to outperform BTC as they have done over the past 90 days. The index can be used to determine whether altcoins in the top 100 cryptocurrencies, ranked by market capitalization, are making gains or lagging behind Bitcoin.

While most altcoins are gaining alongside Bitcoin in the top 50 this week, Render, Sui, Pepe, Hyperliquid and Ondo are the five tokens to keep an eye on.

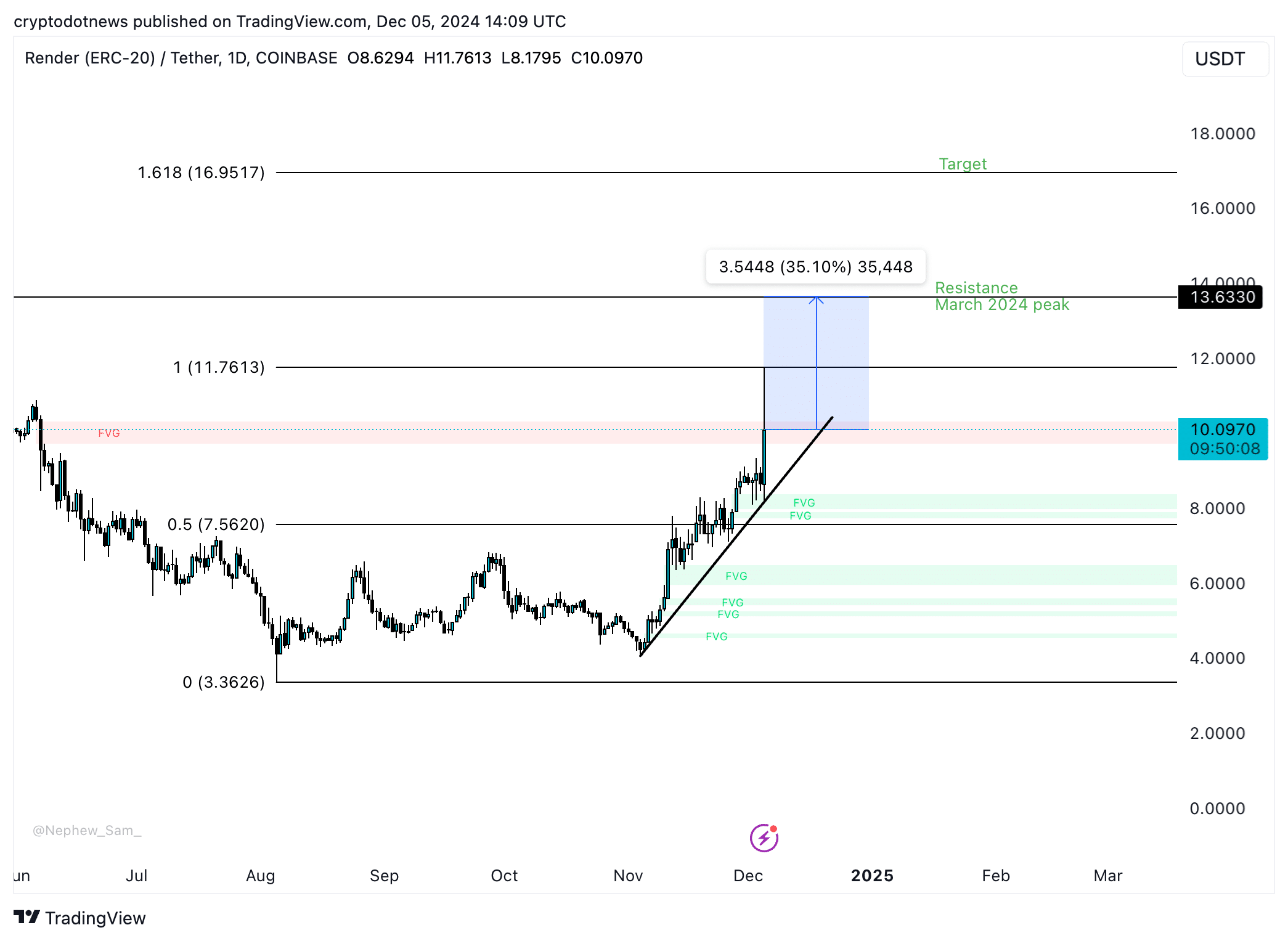

Render rallied near its March 2024 peak at $11.7613. A 35% rebound from current price could see RNDR test resistance at $13.6330. Technical indicators, relative strength index and moving average convergence/divergence support the thesis of a price increase in RNDR.

The 161.80% Fibonacci retracement of the RNDR rally sets $16.9517 as the cycle high and price discovery target in this cycle.

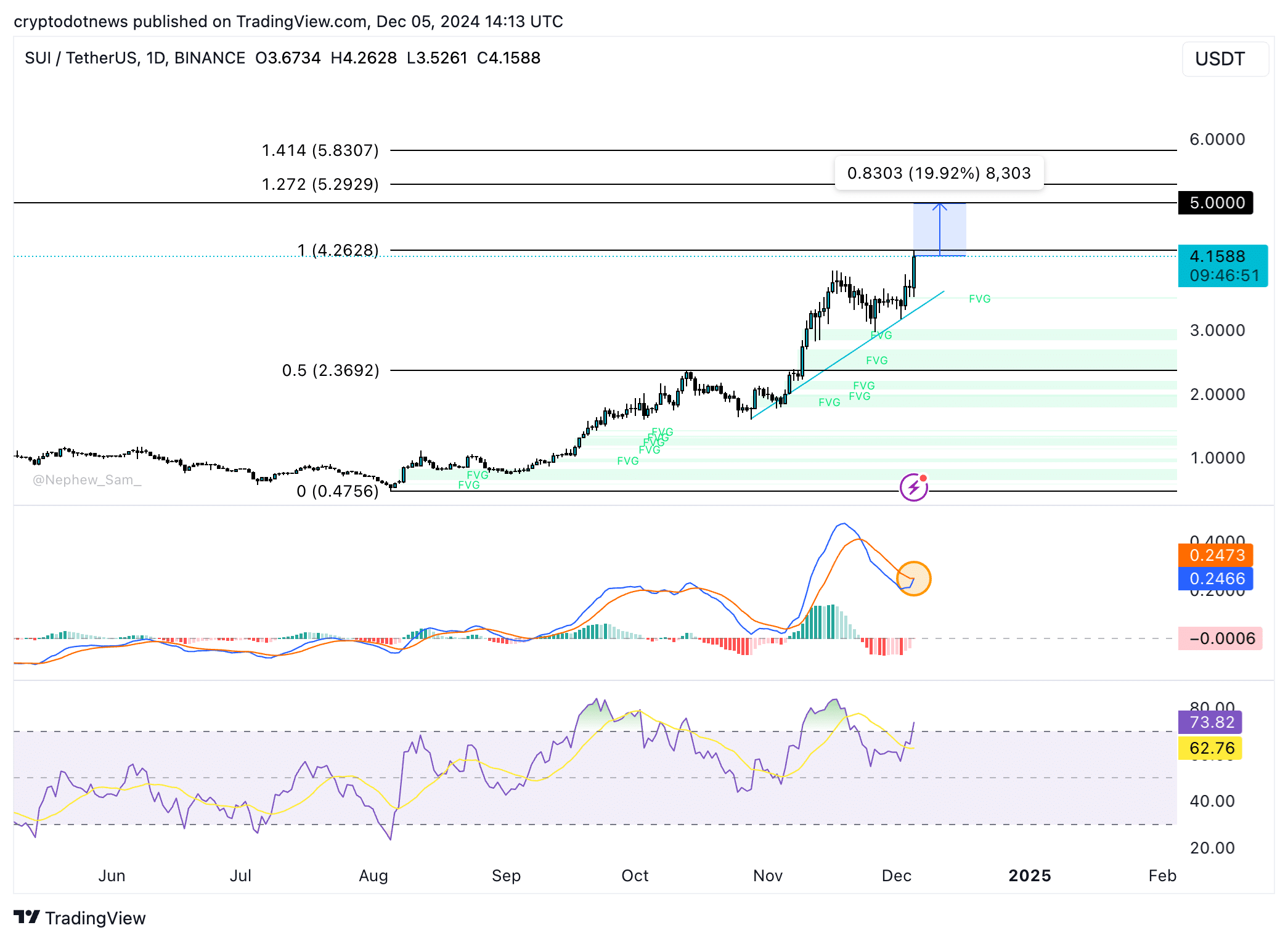

SUI is almost 20% away from its psychologically important $5 target. The Sui token is trading at $4.1588 on December 5, rallying alongside Bitcoin.

The RSI has crossed 70. Normally this would generate a sell signal for traders. However, MACD could see the MACD line cross above the signal line, which is a bullish sign for SUI.

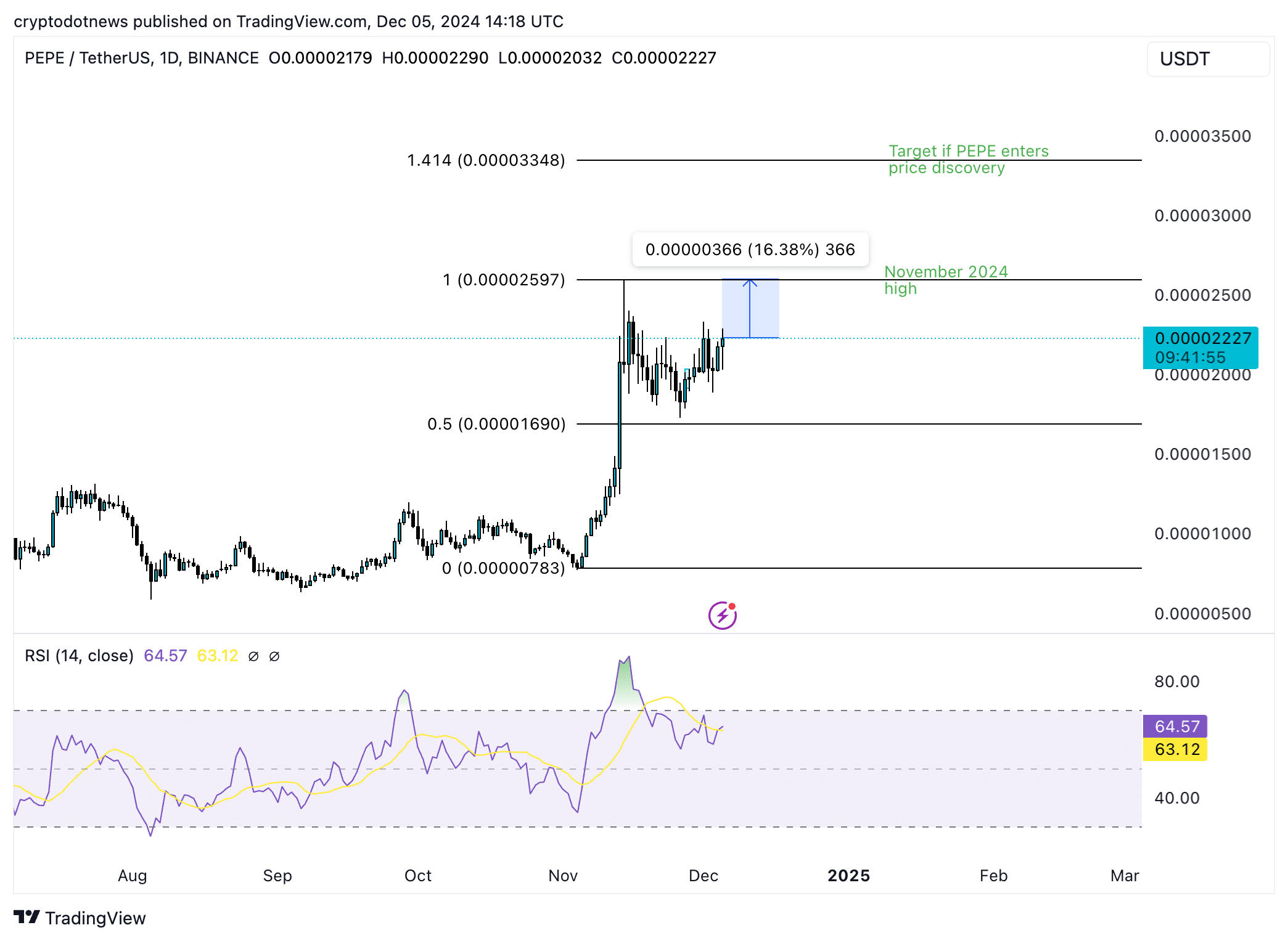

PEPE is preparing to test its November 2024 peak of $0.00002597, which is almost 17% above the current price level.

The RSI is trending up and below the 70 level, meaning PEPE is not yet in overvalued territory. PEPE could start price discovery once it breaks its November peak; $0.00003348 is the price discovery target for PEPE.

The target coincides with the 141.40% Fibonacci retracement of the November price rally.

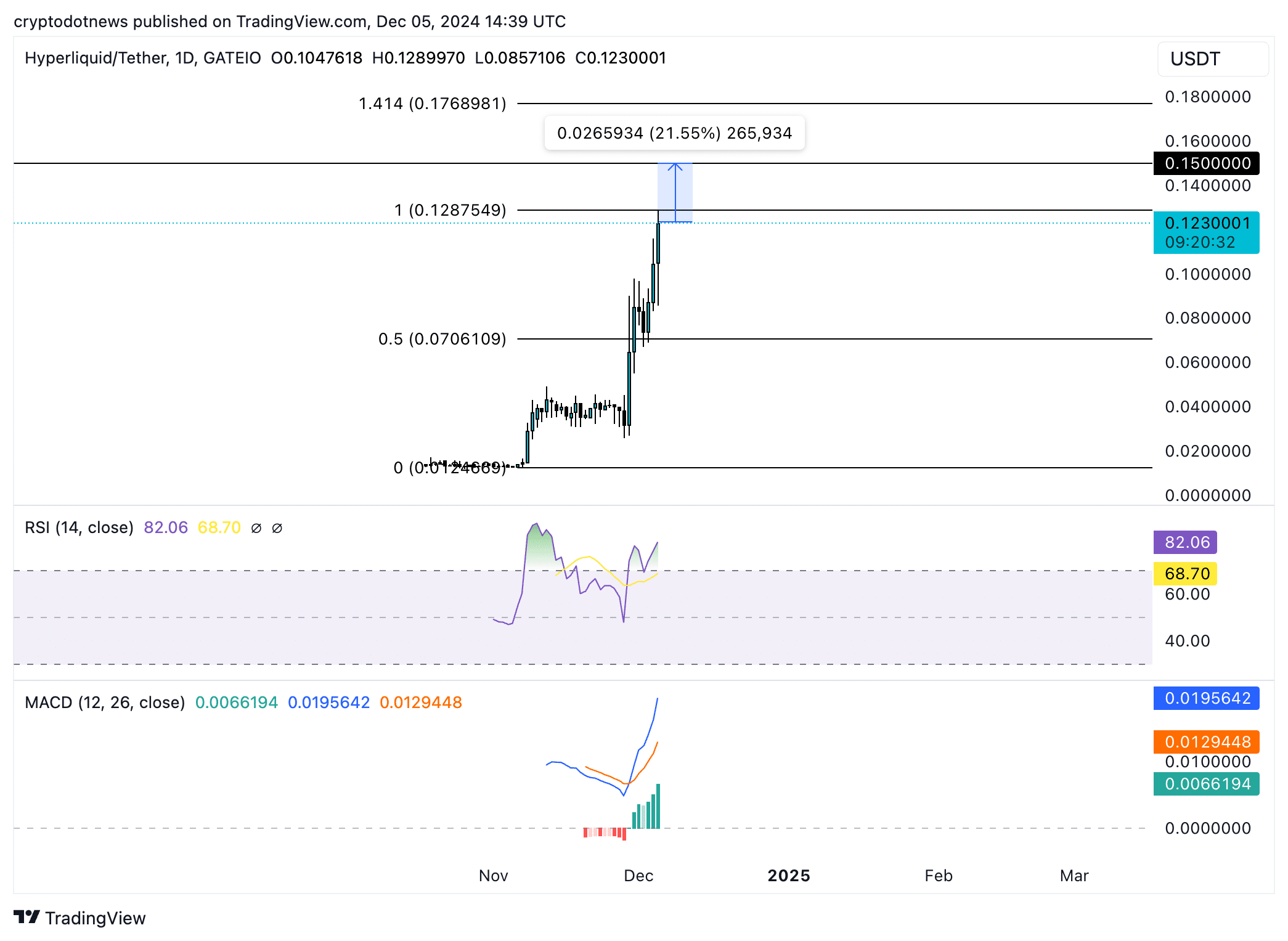

HYPE hit a new all-time high of $0.12875 on Thursday. The token could rise to the psychologically important $0.15000 level, almost 22% above the current price.

A successful break of this level could bring the $0.17689 target into play. This represents the 141.40% Fibonacci retracement of the HYPE rally to its new all-time high.

Technical indicators support the thesis of a rise in HYPE price.

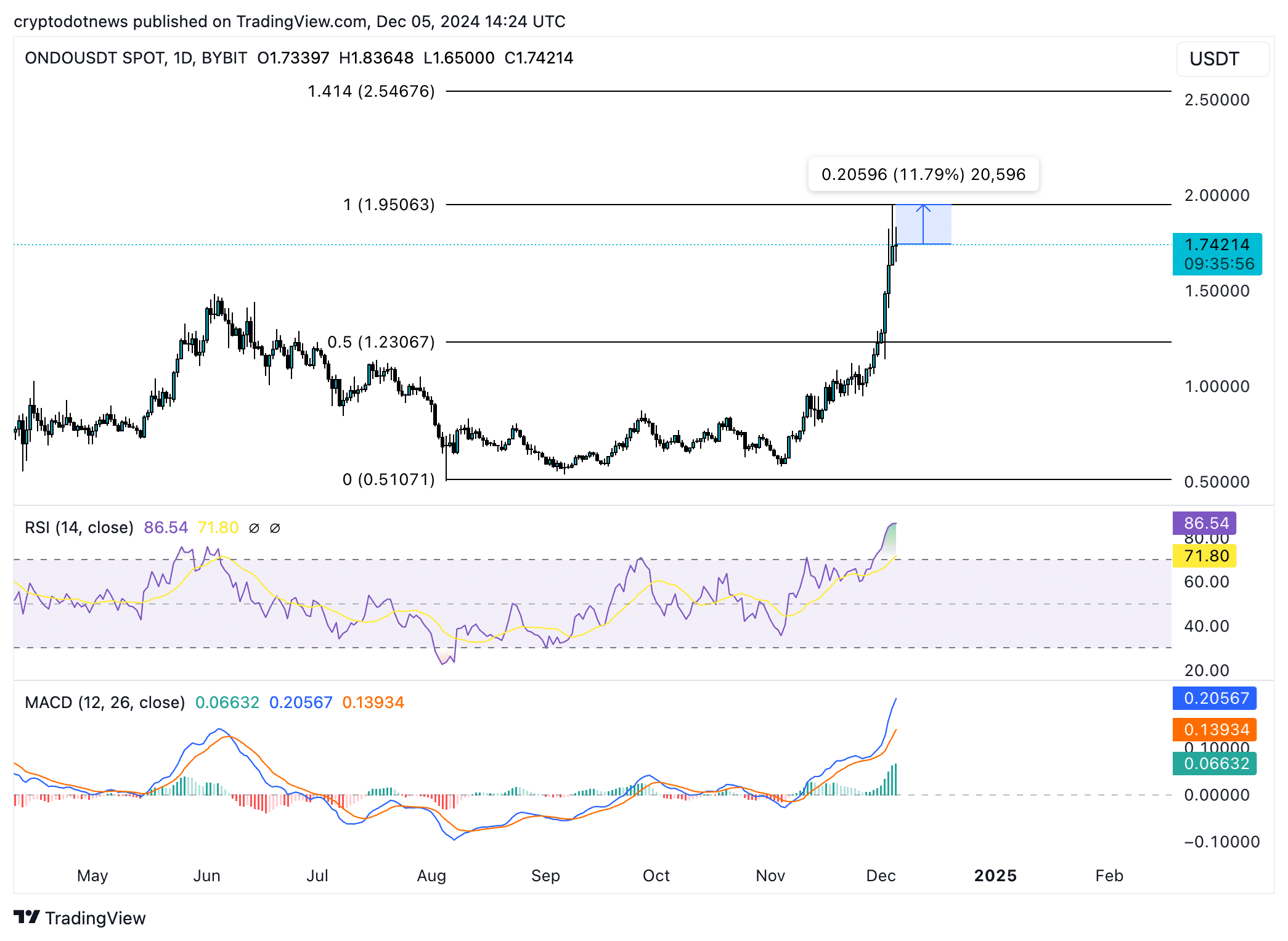

ONDO is trading at $1.74214 at the time of writing. The token is 12% away from its all-time high of $1.95063.

The RSI is trending upwards and shows that ONDO is currently overvalued at 86. While this is usually viewed as a sell signal for the token, MACD has green histogram bars flashing above the neutral line, indicating underlying positive momentum in ONDO price.

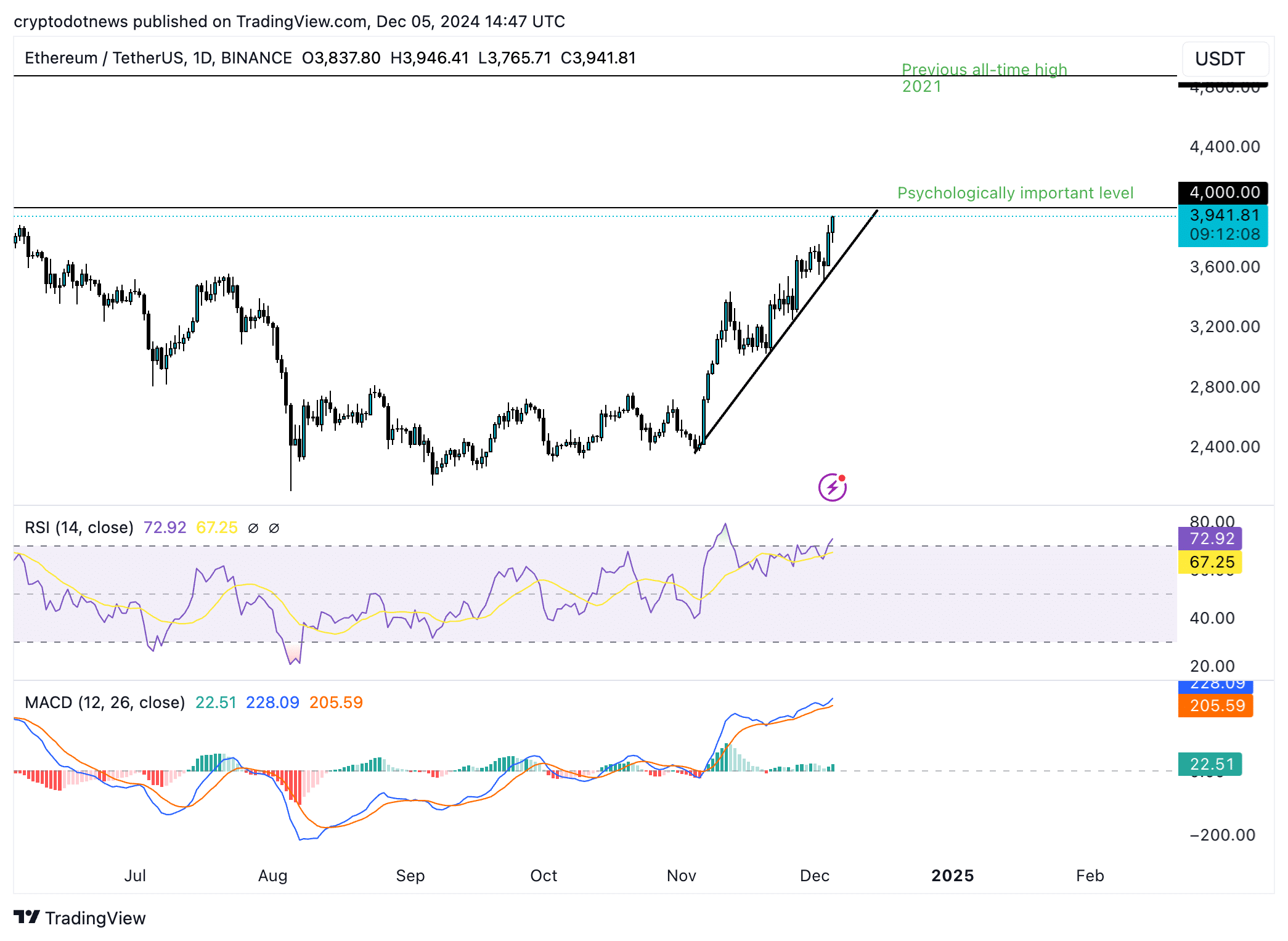

Ethereum is preparing for gains

Ethereum is in an uptrend. The altcoin could target its previous all-time high at $4,878 if the altcoin maintains its uptrend.

ETH price needs to break the psychologically important $4,000 level to target the previous all-time high and enter price discovery in this cycle. With upcoming ecosystem developments and increased utility and adoption of Layer 2 and Layer 3 chains, Ethereum is preparing for further gains.

The RSI is trending upwards and crosses 70. MACD signals underlying positive momentum in the Ethereum price trend on the daily time frame.

Strategic considerations

As Bitcoin’s dominance continues its upward trend and XRP attempts to dethrone USD Tether (USDT) as the third-largest cryptocurrency, traders are shifting capital to altcoins, XRP and Solana (SOL)-based meme coins and artificial intelligence tokens.

According to Coinglass data, over $135 million worth of short sales were liquidated in the last 24 hours. Bitcoin’s rise to $104,000 increased open interest by nearly 12% and options trading volume by 125%.

Traders regularly take profits on Bitcoin, supporting the capital rotation thesis.

CryptoQuant’s Ki Young Ju argues that this cycle is different from previous ones. Institutional investors who buy Bitcoin have no interest in moving into altcoins, meaning altcoin price increases are based on an inflow of capital from retail traders via crypto exchange platforms.

Traders need to keep an eye on exchange user activity and the altcoin market cap chart to determine the highest cycle for altcoins this season.

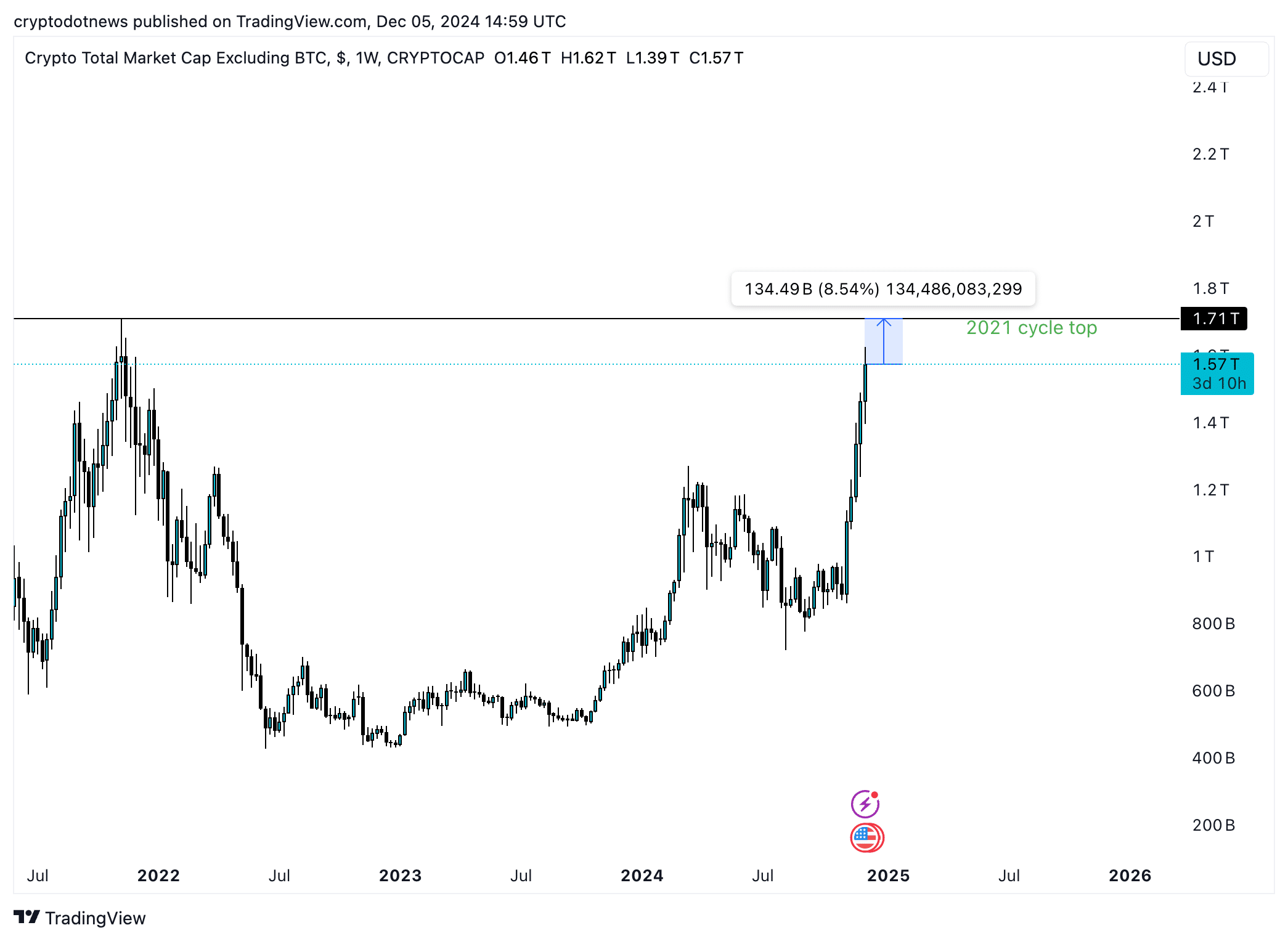

Total crypto market cap, excluding Bitcoin, is still 8.5% below its 2021 cycle peak of $1.71 trillion. As retail traders invest capital in crypto exchanges, the market cap is expected to rise to over $1.57 trillion.

The chart is crucial for traders looking to invest in altcoins while Bitcoin remains stable above $100,000.

Disclosure: This article does not constitute investment advice. The content and materials presented on this site are for educational purposes only.

Leave a Reply