Bitcoin (BTC) and the broader crypto market are seeing strong demand for bullish leveraged plays, a sign that the market is overheated. While market makers’ hedging is likely to keep BTC supported at around $100,000, the increased activity increases the risk of pullbacks for other cryptocurrencies.

Bitcoin, the leading cryptocurrency by market value, hit a record high of over $103,000 early Thursday after President-elect Donald Trump decided to appoint Paul Atkins, a crypto proponent, as chairman of the Securities and Exchange Commission (SEC). .

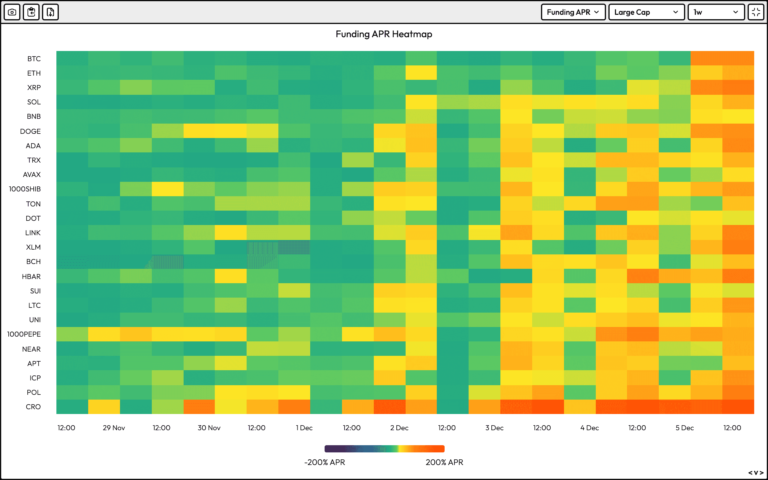

The breakout caused traders to chase the price rally, driving up funding rates for perpetual futures, a sign of growing demand for and overcrowding of long positions. In this scenario, a slight decline can lead to large liquidations (forced selling by exchanges due to margin squeeze) and increased downward volatility.

Support could come from the options market, according to Griffin Ardern, head of options trading and research at crypto financial platform BloFin. When option prices rise faster than those of the underlying asset – that is, when the so-called gamma imbalance is positive – market makers tend to sell their holdings to keep their net exposure neutral. They buy when it is negative, acting as a contrarian force and limiting price fluctuations.

“BTC can remain stable around $100,000 in the near term, supported by market makers’ hedging activity,” Ardern told CoinDesk. “This support from the options market can offset the impact of deleveraging to some extent.”

The annual funding rate for Bitcoin rose to nearly 100%, surpassing rates for purely speculative tokens like DOGE, data from VeloData shows. Other coins such as XRP, CRO and XMR also have funding rates of over 100%.

“This EOD (volume weighted average price) suggests that Saylor wasted a few billion more, and the (BTC) funding rates lead me to believe that this latest move was purely leverage driven,” said Felix Hartmann, founder and managing partner of Hartmann Capital Michael Saylor, CEO of MicroStrategy, the largest publicly traded Bitcoin holder. “I wouldn’t be shocked at a good old 20-30% bull market correction here. The 80s are fair game.”

Hartmann emphasized the need for additional demand beyond MSTR purchases to sustain the bull market, a view echoed by several observers on social media. They suggested that the market will either continue to rise, justifying the costs associated with holding bullish bets, or trend lower in the wake of a sharp correction.

Despite the activity of market makers, Bitcoin price volatility could return towards the end of the year.

“The positive gamma “With $105,000 worth of options expiring on December 27, that could provide enough weight, but after expiry it will disappear, increasing price uncertainty,” Ardern told CoinDesk.

Options are derivative contracts that give the buyer the right, but not the obligation, to buy or sell the underlying asset at a specified price at a later date. A call or bullish bet gives the right to buy, while a put gives the right to sell.

Leave a Reply